By Nyandano Tshikororo

Nicollete Mashile is a Bushbuckridge born entrepreneur, financial adviser, renowned award winner. She was invited at the IIIE Rosebank College Financial Workshop on the 31 of July 2024 as a guest speaker to speak and educate students on how they should be able to handle and manage their money.

This Financial Literacy was not only to educate students, but to educate both students and lectures, as they were some of the lectures who attended the workshop. The financial literacy workshop was all about how students should save money, how they should be financially wise while making decisions that requires money, what to tools they need when making a financial decision, and what mistakes not make while you’re on your financial journey like for instance opening a cheque account, stop paying maintenance and using money on unnecessary stuff.

Discussing on the topic which says, ‘What does your future look like when it comes to money’, “It is important to know where you are going in the coming 5 to 10, set goals, long and short looking on how much money you make per month”, said Nicollet. Like for instance Nicollete makes money from her speaking gigs, MC’ing, television, and influencing, so looking on how she makes money or how much money she is making a month.

It will assist her make decisions and planning goals and be able to set and end goals in time, it is important to make decisions based on your goals on your saving journey. A lot can happen during the saving journey, there could be mid-life crisis, and some unexpected events that will destruct or disturb your saving journey, which will force one to re-route to a different goal.

From Planning to budgeting, as budgeting helps one to save. Budgeting helps one check their spendings, could be too much or too little to leave them with a disposable income which some tend to spend it unnecessarily. Budgeting will reveal to you if you are living above your means, living above your means will strain you financially. “The best way if you cannot handle your liabilities is to reduce your liabilities”, added Nicollete.

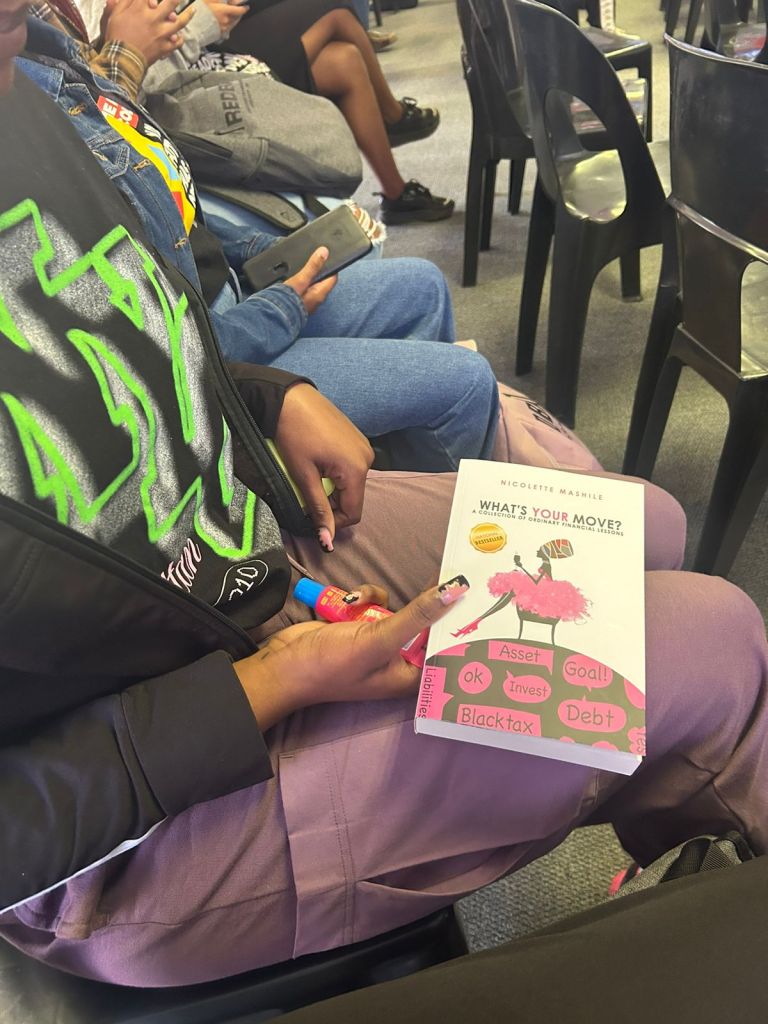

She also gave the student best ways on how to save money, how to invest, on what should we invest and what to be caution about when we have money. From speaking to playing financial quizzes, prizes won by the top student who participated in the quiz, some won cash prizes and some won books written by Nicollete.

Have a financial knowledge for students at this point is a good thing for them to know and be financial wise as they still have life after college.

Leave a comment